System Architect | Alan Miltz: alanmiltz.com

In order for your business to succeed financially, you need to have a good insight into how well it is performing. You are likely to already have a budget in place, but probably realise that it’s possible to miss blind spots that could be affecting your company in a big way without proper analysis and reporting.

By creating a monthly financial scorecard, you’ll have a strategic tool that will not only help you to understand the drivers of cash flow and returns, but to also drive financial performance across the business.You’ll be able to clearly see what areas are doing well, and be able to take action on those areas that need to be brought back on track.

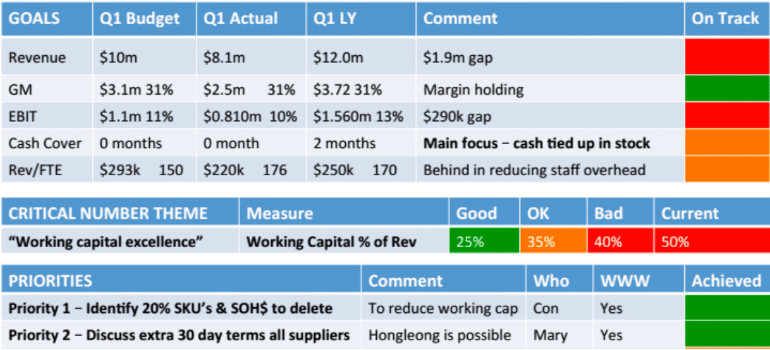

How to Generate a Monthly Financial Scorecard

Step 1: Create a one-page monthly financial score card.

One-page financial record that contains 4 chapters.

- Chapter 1: Profitability –your profit.

- Chapter 2: Working Capital –equals = (Receivables+ Inventory or Work in Progress) –Payables

- Chapter 3: Other Capital –your Balance Sheet.

- > Funding (Net Debt + Equity) = Net Operating Assets (Working Capital + Other Capital).

- Chapter 4: Funding and Returns –your funding as measured by your cash flow.

- > The quickway to calculate Chapter 4 is the movement in all your bank accounts – that’s the reconciliation of cash.

Step 2: Calculate and include your marginal cash flow on your financial scorecard.

Marginal cashflow calculation:Gross Margin % –Working Capital %

Formula = (Gross Margin / Revenue)–[Working Capital (Debtors + Inventory / WIP + Creditors)/Revenue]

Step 3: Create visibility in your company.

- Create your Ideal profile/target for each measure in your Profitability and Working Capital.

- Colour code your business for each of the measures Good (Green) / Average (Yellow) / Bad (Red) for each of the business ratios.

Step 4:The financial health review process.

- Review your one page scorecard and the colours (green, orange, red) that you are getting each month.Look at your trends inWorking Capital

- Working Capital Timeline (CreditorDays, Stock Days, DebtorDays)

- Profitability trends (Gross Margin %, EBIT %, Net Profit %)

- Revenue Growth vs. Overheads Growth

Step 5: Define actions based on 7 levers to improve business.

On a quarterly basis discuss with your management what changes can be made to move the 7 levers to improve profit, cash flow and business value:

- Price increase %

- Volume increase %

- COGS reduction %

- Overheads reduction %

- Reduction in Debtors Days

- Inventory / WIP –reduction in Stock Days

- Increase in Creditors Days

Step 6: Rinse and repeat – review results and define new actions.

As you can see from the above example, a financial scorecard clearly outlines how your business is performing compared to your budget. By colour coding each item, you can easily see what areas are on track and what areas are not doing so well.

While you will want to celebrate the areas that are on track, it’s the red and orange areas that you’ll be wanting to discuss with your management team and decide what changes need to be made to get things back on track. As a team you can organise who will take action on these, and then decide at the end of the next meeting if these actions have been achieved.

Setting up your financial scorecard will not take very long, and should only require a few hours of work each month to bring it up to date. By having a clearer picture of your financial performance, you will be able to drive your business towards achieving its financial goals.

System Architect – Alan Miltz

Alan Miltz has changed the way in which banks and businesses review financial performance. His analysis techniques are used in over 30 countries by leading banks, businesses and accounting firms.

Alan has presented to over 5000 business leaders globally. in his dynamic presentations, Alan employs interactive tools and live case studies to highlight the significance of these performance measures and comprehensively describes how to implement them. Even seasoned financial professionals who thought they had seen and heard it all have been “wowed” by Alan Miltz’s penetrating analysis.