50 Financial Advisors, Bookkeepers & Accountants Reveal Their

‘Best Kept Secrets’ for Scaling a Business, Any Business, Beyond the Founder!

Do you sometimes feel like your business is an adult daycare centre? Are you constantly repeating yourself, fixing errors and trying to hold things together? What if it were possible to create a business that runs itself?

You’ve dreamed about it – now it’s time to make this a reality!

If you’re anything like many seasoned business owners, you’ve tried and failed to systemise your business. The reality is, your shiny business isn’t as functional as it looks from the outside; it’s unorganised, inconsistent and key-person dependent. Whether intentional or not, you’ve created a business completely dependent on you!

How did you end up here? Why are you stuck? And more importantly… How do you break free?

The simple answer is to develop your business systems. This refers to the non-urgent but vital task of extracting, organizing and optimizing the functionality of your business.

But the question still remains… where do you start?

That’s where this is where this article will help. Yes, you’ve found a “shortcut”.

We know how challenging systems and processes can be for many business owners… you often don’t know where to start… So, we thought we’d grill 50 of the top accountants, bookkeepers and financial advisors, asking them to share their insights with us.

We asked them all the same million-dollar question…

“What do you think is the most important process/system that most small businesses overlook when it comes to growing beyond the founder?”

Then, we collated the answers for you below…

Are you ready to significantly improve the systemization and scaling of your small business or internet venture?

Also, please remember to share this post with other business owners you care about! Let’s dive right in.

Let’s take a look at our expert business coaches:

David Jenyns

Sam Dogen

Eric Rosenberg

Gary Johnson

Raymond Young

Rita Keller

Ryan Lazanis

Diane L. Gilabert

Andrew Spafford

Sal Rezai

Samantha Richardson

Nikole Mackenzie

Michael Peever

Shawn Gander

Shaye Thyer

Ashley Leeds

Michael Eckstein

Monil Shah

Gary Duell

Adit Shirvalkar

Brad Guiso

Carrie McKeegan

Sarah Burton

Dan Heelan

Henry Daas

Wahidah Aziz

Ervin Nixon Cruz

Enpo Tu

Marc Page

Paul Desruisseaux

Rennie Gabriel

Ben Nowlan

Joshua S. Duncan

Tania Brown

Ron Lesh

F. Elusio Zafar Alcalde

Louis Marchman

Kaiyah Bean

Elizabeth Leonard

Cindy Schroeder

Cheryl Graham

Sherry Thomason

Jen Fontanilla

Loren Fogelman

Jody Seibert

Christina Honeycutt

Matthew Tansley

David Merkel

Martin Beadle

The first and most important system any business owner can put in place is the system for creating systems. I know it sounds like a funny name but it’s serious business. Typically the business owner is the worst person within an organisation to be putting systems and processes into place. The sooner this is delegated to other capable team members, the sooner the business can begin to grow.

When I realised this, I realised all I needed was the master system to inform the creation of all future systems. Hence the “System For Creating Systems” was born. With this system, any team member can document, organize and optimize how they do things – this system completely takes you out of the loop!

Then, with each new system, you’re pushed further out of the daily grind as staff are able to complete tasks to a higher standard and with less support. If you’re interested to find out more, I’m happy to share this system with you – click here to download it.

Tweet This Quote

You must have a system for creating systems – it’s the most important business process of them all.

David Jenyns

Tweet this quote – click here

I think it’s important to have a consistent voice when it comes to writing. Write from firsthand experience. Once you do, the voice will naturally come.

If you want to scale up and hire staff writers, all staff writers need to know your voice.

Even better if they know your voice even better than you do.

Further, you need to be dependable.

You can’t provide a product one day and then disappear for a couple months and then expect your audience and customers to stick around.

The secret to any entrepreneur’s success is to stick with things long enough to see the flowers bloom.

Tweet This Quote

The secret to any entrepreneur’s success is to stick with things long enough to see the flowers bloom.

Sam Dogen

Tweet this quote – click here

One of the most important parts of a business is its finances, which is why I’m always shocked when a founder ignores accounting and bookkeeping needs.

Even if they don’t do it themselves, looking at financial results can help a business owner find growth opportunities.

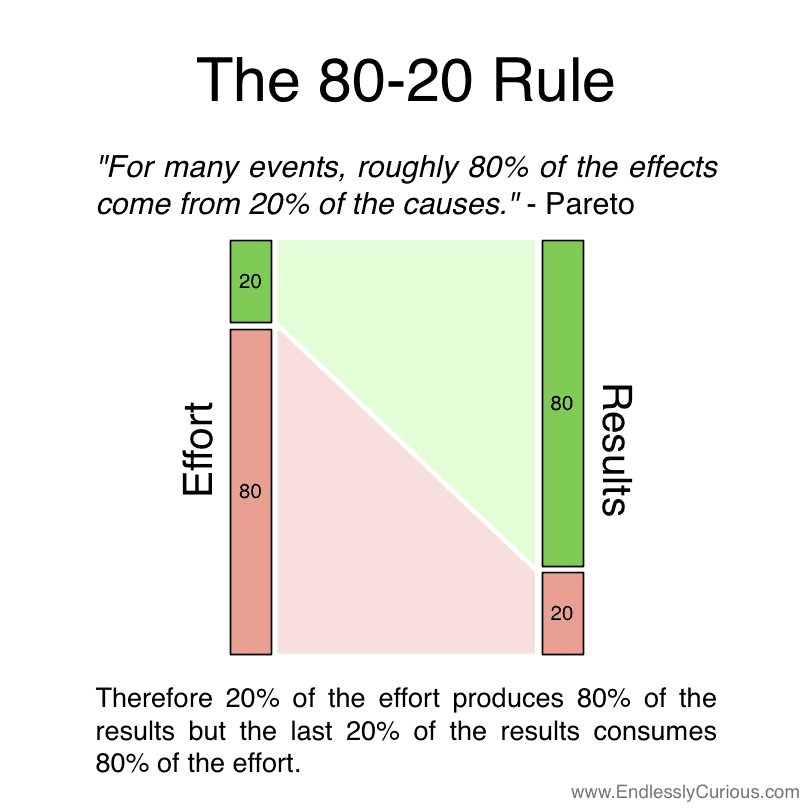

For example, I was looking at my accounting records a few years ago and noticed an almost exact 80/20 opportunity. Following the 80/20 rule, or Pareto Principle, I cut a major section from my business and that revenue went away instantly. But a few months later, it tripled to a new monthly record.

There’s a reason companies employ teams of financial analysts.

When you own a business, you have to be your own analyst. But doing so is definitely worth the time and effort. It can help take your business to new heights.

Tweet This Quote

Even if they don’t do it themselves, looking at financial results can help a business owner find growth opportunities.

Eric Rosenberg

Tweet this quote – click here

The founder of the business should decide what accounting/financial information is needed to effectively manage the growth of the business and then let the professionals implement and manage the system.

Tweet This Quote

A business needs a system that has the ability to track the real results of the business and project what may happen to the business in the future.

Gary Johnson

Tweet this quote – click here

Many business owners feel they can do the job best themselves. That’s true many times. But it’s even more powerful to have many mini-me’s and to have people even more talented than you, work for you.

So that you, the business owner, can take a bigger world view of your business than be bogged down by the day to day minutiae.

I am a CPA, who even though old, embraced the web, just as much as the young whippersnappers. But some of my people are way smarter than me, and I appreciate that very much.

Tweet This Quote

Many business owners feel they can do the job best themselves. That’s true many times. But it’s even more powerful to have many mini-me’s and to have people even more talented than you, work for you.

Raymond Young

Tweet this quote – click here

It has been my observation, in working with CPA firms, that the “next generation” taking over from a founder and long-time leader that they usually go too far in the opposite direction.

If a founder is a strict dictator, the successors tend to become too lenient.

If the founder was too lenient, the new leaders go too far into a more strict culture.

My advice is to be aware of these tendencies and make changes to culture carefully and slowly.

Tweet This Quote

Make changes to culture carefully and slowly.

Rita Keller

Tweet this quote – click here

I’d say the most important process that’s overlooked by the founder is the strategic planning process.

With my first business, I had a hard time developing a proper cadence and routine around strategic planning. It was mostly because I didn’t know what to do and also because I was very busy with other matters.

As a result, I neglected this part of the business. Even though the business grew from a one-man show to a team of 15 that was acquired by a much larger organization, I could have likely done a lot better with just a simple strategic planning process in place.

Now, with my second business, I developed a methodology that’s simple where I review and update the plan quarterly. It helps keep me on track, keep me clear and ensure that there’s traction in the business.

I advocate for following the principals in the book “Traction” where you map out your long term objectives first and then work backward to arrive at actionable 90-day goals for you to focus your next quarter on.

Any other distraction over and above working on your 90-day goals should be pushed aside.

Tweet This Quote

I’d say the most important process that’s overlooked by the founder is the strategic planning process.

Ryan Lazanis

Tweet this quote – click here

Additional Reading

- 5 Tips to Turn Your Firm’s Website into a Marketing Tool

- Run a Firm You Love by Defining Your Personal Goals

- Marketing for Accountants: The Top 18 Strategies

“It depends” on the type of business.

What I’ve seen over the years is the founder has trouble letting go/outsourcing non-critical business functions and so spends too much of his/her time on those instead of focusing on the drivers of the business’s growth and success.

The founder should determine with his/her management team what are the goals of the business and what will it take to reach them in the short, middle, and long term.

Then resources, including time, should be devoted to achieving those goals. Everything else should be outsourced.

Where does the management team/founder spend a lot of unproductive time? Is it IT? Employee benefits? Accounting? Payroll?

Those are all easy to outsource.

Less obvious and often more difficult to define are creating systems to produce a “dashboard” the founder and the management team can use to quickly see if they’re on track to reach their goals, and where they’re falling short.

Do they need to track lead generation? Sales conversion? Turnaround time for responding to RFPs? Customer satisfaction? Time to ship a product/service? Employee productivity?

You get the idea.

Tweet This Quote

What I’ve seen over the years is the founder has trouble letting go/outsourcing non-critical business functions

Diane L. Gilabert

Tweet this quote – click here

Most organisations don’t have the technology foundations to automate common administration processes.

As they grow they get inundated with non-value add tasks that take them away from what has driven the growth in the first place….their idea, IP.

Simple things like on-line forms linked to their website take away the need to be inundated with unnecessary emails.

The ability to outsource non core requirements lets them also focus on their growth strategy.

Tweet This Quote

Simple things like on-line forms linked to their website take away the need to be inundated with unnecessary emails.

Andrew Spafford

Tweet this quote – click here

I think when businesses growing beyond the founder they should not overlook the following goes in order:

Instead of overlooking company culture better to have a plan to foster that plan and develop the initial spirit as the numbers grow. Company culture is what brought the company in the first place, so it is imperative not to lose it at all.

Cash flow, no one should overlook how much money is coming in, and balance it with the money they are spending to grow.

As Warren Buffet says: “Cash or available credit is like oxygen: you don’t notice it 99.9 percent of the time, but when absent, it’s the only thing you notice.”

And last is financial and financial reporting, which is the beating heart of an organization, when done well and delivered consistently there is no better way to measure the progress of all areas of any business.

Tweet This Quote

Instead of overlooking company culture better to have a plan to foster that plan and develop the initial spirit as the numbers grow.

Sal Rezai

Tweet this quote – click here

In my experience, both in my own practice and with my clients, hiring the first few people and having a process to onboard them so they can be successful in that role has been the most difficult barrier to growing beyond the founder.

The founder (in the beginning) has probably not documented things very well. They have all the client and system process knowledge in their head instead of on paper, so sharing that knowledge with initial employees or contractors can be very challenging.

In my experience, the documentation of a work process has been the biggest pain point as it is time-consuming and you don’t get it right the first time, so you have to keep coming back and improving it.

Once that onboarding process is working smoothly, it’s a lot easier to hire new employees as the training period is shorter and smoother.

I’ll give an example from my business but this is the same issue for most of my clients, the only difference is their industry or the specifics of their workflow.

I’m currently in the process of creating a procedure document, containing specific notes about how to onboard a client.

The first challenge is getting this process out of my head and onto paper, and the second is finding the time to do it.

I knew that I should have created this document as I was building my business and as I was onboarding new clients, but after working on business growth and service delivery, there isn’t a lot left over at the end of the day to create documentation.

I’ve worked in organisations before who have a procedure document for everything, and know from personal experience how helpful it is to get up to speed on my job if this documentation exists.

Most clients have also worked in larger organisations with these procedures or documented processes, but also fall into the trap of never documenting anything until they need to show someone else how to do the job.

This creates a *lot* of headaches for the initial hires as well because they aren’t able to do their job as effectively.

When I hired my first employee, I did not create this onboarding document and instead walked this person through the process, but it meant I wasted that time because after I had to replace that employee, there was still no documentation to help the replacement person do their job.

It doesn’t help that documentation is pretty boring and something I don’t want to spend my limited time on. Most of my clients are in similar situations and it is why some of them have chosen not to add people to their organisation – because they don’t want the administrative headache.

Tweet This Quote

Once that onboarding process is working smoothly, it’s a lot easier to hire new employees as the training period is shorter and smoother.

Samantha Richardson

Tweet this quote – click here

The most important process that most small business owners overlook when it comes to growing beyond the founder and moving into the CEO role is not thinking about how the business will look as a larger enterprise, starting at day 1. By that, I mean, setting up and documenting roles from the very beginning.

You should have an accounting department, a marketing department, an IT department, a documented sale process etc.

In the beginning, the founder may be wearing most or all of these hats, then as the company grows they should strategically fill these roles through an outsourced/part-time solution and then finally in-house hires once the company gets big enough.

By beginning with the end in mind, the founder will have a clear path on how they can transition themselves out of the founder role and into the CEO role.

Tweet This Quote

By beginning with the end in mind, the founder will have a clear path on how they can transition themselves out of the founder role and into the CEO role.

Nikole Mackenzie

Tweet this quote – click here

The answer is: giving up control.

Most small business owners are great at what they do i.e. a great baker or programmer or whatever it is that they do.

So, they may be great at what they do, but not so good at the other necessary requirements of growing a business, such as allocating different responsibilities to different team members and letting them “do their thing”.

And attached to this is the notion of giving up control.

However, what many don’t realize is that they’re not really giving up control at all.

They’re just getting the valuable members of their team to do what THEY do best. Often, the owner will over manage and not allow the capable people to do what they do best.

“Stay in your own lane” is a phrase I use with clients who often second-guess my recommendations and decisions.

Tweet This Quote

“Stay in your own lane” is a phrase I use with clients who often second-guess my recommendations and decisions.

Michael Peever

Tweet this quote – click here

Most small business owners don’t grow beyond the founder because they don’t implement repeatable systems/processes with tasks that can be delegated to employees.

Accurate accounting data is critical to making solid business decisions, which is why my firm uses Xero (cloud accounting software).

Xero further helps streamline systems/processes by integrating with hundreds of other applications such as Hubdoc, Wagepoint and Rotessa.

Rotessa, for example, can help automate payment collection so that businesses aren’t chasing down accounts receivable.

The accounting system serves as a good base, but business owners need to look at all individual processes and standardize them in order to make real efficiency gains.

Tweet This Quote

Accurate accounting data is critical to making solid business decisions.

Shawn Gander

Tweet this quote – click here

Additional Reading

The most important process/system that most small businesses overlook when it comes to growing beyond the founder is a well oiled, highly automated and integrated finance function.

Most small businesses want to delay or minimise paying for help with their business finances as much as possible, not only so that they can minimise overheads, but so that they don’t lose touch with that side of the business.

In reality though, what we commonly see is very poorly managed finance functions with a lack of visibility over (in particular) cash flow, and a great deal of time sucked from the business in either managing this or rectifying this situation.

Small business owners should be building their finance functions with the future in mind but with enough simplicity to get the basics done well now.

An example of this is leveraging a cloud accounting solution that features automatic connection with bank transaction information,

a user interface that speaks to business owners (ie not just for finance people and accountants), automation across invoicing to assist with low-touch debtor management and cash flow and seamless interaction with an adviser/accountant.

The first place small businesses should look to for advice about accounting systems is their accountant.

Many cloud accounting systems are just so easy to use these days that business owners can get sucked into the temptation to select and move across on their own.

Did you know that there is up to 5 x the work and cost involved in fixing a poorly implemented accounting system than engaging a cloud accountant from the get go!?!

Now what if your accountant can’t help, and can’t refer you to someone that can? I’d boldly say – it’s time for a new accountant! Small businesses need a trusted adviser in their corner, someone who is not only technically brilliant, but has their best interests at heart – genuinely.

They’ll be experienced in cloud-accounting because the cloud is good for both business and adviser – one single ledger, one source of truth for you both to work from.

No more paying for old-school re-keying of data from your system to thiers, and no more sending files via email, or usb, or worse, in a shoebox full of paper!

When you work with an adviser who embraces the cloud you’ll be able to access exponentially more value for your hard earned dollars.

Tweet This Quote

Many cloud accounting systems are just so easy to use these days that business owners can get sucked into the temptation to select and move across on their own.

Shaye Thyer

Tweet this quote – click here

Ashley Leeds

— Helping accountants Prosper. Tech lover. Singer. Guide Dog Puppy Walker. Actor. Father and Husband.

Visit Ashley’s Twitter

Many business owners got too focussed on what they do to save money and rather than hire someone to do the work they sucked into doing the work and not working on the business.

It’s a mindset thing. They set up their business because they like the doing, but in order to grow and make money they need to have bigger visions and these cannot be achieved if they are still concentrating on the little things that could be delegated or outsourced.

We work with accountants who have been trained to do books, accounts and tax work and they do this because that’s their job and they really enjoy this work.

They see this as the way to put money on the table, but what they fail to realise is their value to the business is much greater than some of this low-value work.

When we are working with our members we will get them to delegate this work straight away or maybe use an outsourcing company to do this for them. This then allows them the time to spend working on some of this work.

I spend a lot of time with our members trying to get them to understand the value of themselves and this can range from anything from £50 to £300 per hour and then I use this example to ask them if they would pay somebody £300 per hour to put the bins out or do filing for example.

When you start looking at things like this you start realising the true value of what you are worth and then you start making sure that you’re not caught up in the work in, work on trap.

Tweet This Quote

It’s a mindset thing. They set up their business because they like the doing, but in order to grow and make money they need to have bigger visions.

Ashley Leeds

Tweet this quote – click here

Michael Eckstein

— Tax, Accounting, & Peace of Mind. Serving tech-savvy freelancers, consultants, and micro-businesses.

Many founders make their first few hires without writing down their systems or having any Standard Operating Procedures (SOPs) in place. Hiring without SOPs causes all sorts of problems across the business.

Some issues could be as simple as emails not being answered in a way the founder would like or invoices being prepared differently. Or, they could be more serious problems like client work isn’t up to the founder’s standards or employees aren’t treating customers appropriately.

Thorough SOPs are crucial to business growth and smooth out some of the bumps along the way.

Tweet This Quote

Thorough SOPs are crucial to business growth and smooth out some of the bumps along the way.

Michael Eckstein

Tweet this quote – click here

What I have observed working with small business owners is that they overlook to budget their cash flow. Activities.

I believe managing cash flow in the most optimal way helps you to prioritize your business

All those founders do have a virtual image on their mind but planning & budgeting on paper is equally important.

When they do not budget their activities they do not know how exactly they want to grow their businesses.

The SME sector always has incredible talent to do what they pursue but not all get equal opportunities in life to become a huge company! Every businessman has to thrive through immense planning to SUCCEED!

We at Finsync Solutions have been helping small business entrepreneurs to create a business plan on papers with our experts who have been in the finance industry from 25 Years.

According to me there are various ways to improve cash flow of which the most important are under:

Optimum Management of Accounts Receivable / Accounts Payable:

Accounts receivables & Accounts payables are the most important stakeholders of the company who can solve as well as create problems in managing cash flow.

Managing receivables by giving attractive discounts and incentives help the company’s to make the payments on time.

Managing payables by either taking discounts or negotiating good terms of payment with the Creditors will help to generate cash flow in crisis situations.

The right ratio and ageing of AR & AP can be determined by taking into various factors and a help of the expert is recommended in it.

Managing Capital Structure:

Capital Structure means the different means of finances available for a business. The leverage of optimum capital structure helps from increasing interest burden more than the return on the business or the investment.

There are various means of finance with different rates of interest, which one to choose during the lifespan of the business should be derived looking into the position of capital structure.

Efficiently managing capital structure could help create an arbitrage and generate more cash flow in the business.

Proper Administration

Administration has a broad meaning for any business and small tasks when are missed may create bigger problems.

There are various admin tasks like proper recording of the sales, follow ups with accounts receivable, reducing or delaying costs, to negotiate good buy or lease arrangements etc.

Small businesses do not have dedicated resources for each task and the owner or founder should take care of these things.

When an administration of the business fails, it can never survive in the market.

Tweet This Quote

I believe managing cash flow in the most optimal way helps you to prioritize your business.

Monil Shah

Tweet this quote – click here

I think the most important thing is to systematize and document everything everyone does in the business, why they do it and how each action meets the mission and furthers the goals of the business, its employees and customers.

In our case that’s done with a detailed procedure manual that we constantly update.

The key is for even the most “obvious” and mundane tasks to be described such that almost anyone could perform them. Here’s the old birthday card procedure, done only by me, for example:

Birthdays- daily

- Open Big Contacts [our CRM]

- Open Reports>Standard Reports

- Open Birthday report

- Click on client who has birthday today

- Cut & paste a birthday blurb into an email, with the subject, “Happy Birthday [first name]! Be sure the right spouse is emailed!

Tweet This Quote

Systematize and document everything everyone does in the business, why they do it and how each action meets the mission and furthers the goals of the business, its employees and customers.

Gary Duell

Tweet this quote – click here

The most important process / system that small businesses overlook is ‘documentation’ of processes. How a small business owner wants to get things done in his business should ideally come from a document like Standard Operating Procedures (‘SOP’).

Such documents afford a rare balance to the owner – to not be personally involved in the orientation of staff, while at the same time retain control over how things happen in his business.

Documented processes aid delegation of not just the execution, but also the supervision, which enable businesses to move beyond their founders.

Therefore it is critical for small businesses to reach out to CPAs or management consultants for a thorough analysis and documentation of how they do their business.

Tweet This Quote

Documented processes aid delegation of not just the execution, but also the supervision, which enable businesses to move beyond their founders.

Adit Shirvalkar

Tweet this quote – click here

Brad Guiso

— Professional Financial Coach at Guiso Financial Coaching

The process /system that small businesses overlook when growing beyond the found is hiring to fill the voids and trusting the people you’ve hired to be the experts you hired them to be. Each person should play to their strength.

The Founder can’t do everything so they need to focus on where they bring the most value and backfill with trusted talent the other areas that are not playing to their greatest value.

A good example of this is my friend John. John runs an insurance agency.

Early on when he first bought his agency John realized that he was great at connecting with customers and had a knack for closing business.

However, with each quote or new policy, there was paperwork to complete and data to be entered into systems. John being the smart guy he is could certainly do those things and do them well.

He also knew that his time was better spent meeting with prospects, providing quotes, and closing more deals.

As his business has grown John has hired people who do that paperwork, enter new clients into the systems, and even hired people who can get back to customers with the quotes they desire.

John remains the face of the business and is the guy who meets with the larger clients, and does most of the face to face meetings.

He’s backfilled with a team who can do the other parts of the business while he does what he’s best at, what he enjoys most, and adds the most value, meeting with and serving customers and prospects.

I think it’s critical for small business owners to identify the areas of the business where they are playing to their biggest strengths and where they drive the most value. As they grow to hire others to take over the tasks that keep them from working where they are most valuable to the business.

Many businesses can hire a bookkeeper, an SEO/Web company, and other tasks that are not the sweet spot for the owner and become much more productive.

For me, with my financial coaching business, I’ve been partnering with a digital marketing person to help me grow my business and web presence which keeps me focused on doing those tasks more efficiently and effectively allowing more time for talking with prospects and helping people take control of their finances and move toward financial wellness.

As all of our businesses grow let’s keep looking for what we can give away that will enable us to keep our attention on where we add the most value.

Tweet This Quote

As all of our businesses grow let’s keep looking for what we can give away that will enable us to keep our attention on where we add the most value.

Brad Guiso

Tweet this quote – click here

When growing a business beyond its founding members, entrepreneurs often neglect to establish standard operating procedures and decision-making parameters for their teams.

Standard Operations Procedures (SOPs) are what make day-to-day operations run smoothly.

SOPs automate workflows and ensure that all employees know how to perform essential tasks to your quality standards, even if the person who usually handles the responsibility is unavailable.

Additionally, managers need to work with their teams to establish decision-making parameters.

The key is to empower your team to make smart, data-driven decisions for the business so this function is distributed throughout the organization, rather than relying solely on leadership to make decisions.

Tweet This Quote

The key is to empower your team to make smart, data-driven decisions for the business so this function is distributed throughout the organization, rather than relying solely on leadership to make decisions.

Carrie McKeegan

Tweet this quote – click here

In short, staff.

As an owner grows a business he/she needs to make sure they employ staff who are also passionate about ‘getting in at the grass roots’ of a new, young business.

People who are willing to deal with all the ups, downs and unknowns that come with expansion, fast or slow, of a usually unknown product or brand name.

He/she also needs to ensure they employ the right number of people. The owner should be dedicating as much time as humanly possible (often 12 – 14hr days, 7 days a week) in order to not grow the wage bill as quickly as they are growing the business!

The owner should, as the old cliche goes, lead by example, be willing to step up and do any job necessary in the business. If they show they are willing to ‘muck in’ and ‘knuckle down’, so too will their staff. A lack of this type of leadership, as I have seen first-hand, is extremely detrimental to how strong and stable a company will be, as it grows.

At a more basic level, the owner should be praised, as well as reprimand. They should be pleasant – a smile goes a long way. They should clearly state their daily, weekly, monthly expectations and not just assume staff know what is needed.

They should have empathy for any problems, professional or personal, their staff may have. They should be open to listening to ideas from their staff.

The bottom line is that staff are your biggest asset. Treat them kindly and with respect and they in turn will treat your business the same way.

Tweet This Quote

The bottom line is that staff are your biggest asset. Treat them kindly and with respect and they in turn will treat your business the same way.

Sarah Burton

Tweet this quote – click here

I actually think it’s documenting systems in general. As owners we all grow naturally and think things are ‘obvious’ or ‘common sense’. This works until you scale and need to train someone to perform that role!

My advice is document everything you do and do it early. You want to be able to teach someone how to do it, so you can replace yourself in that role.

For example with the accounting function. Could you teach someone else how to invoice for you? Do you have a ‘standard’ way of invoicing? Do you have a cloud system to ensure visibility, non duplication of invoices and easy collaboration?

In terms of capturing expenses – do you have a system for logging receipts. How easy is it to repay your team member for expenses (like milk for the office)? Do you have a checking process for these expenses?

If you invoice, do you have a system for regularly updating your book-keeping, so you know who owes you what? Do you have a system to chase that debt?

Accounting and finance is often an area people outsource early, so building a system for this is a key one to create early.

Also, without cash, there is no business – so it’s key to business success and survival.

Tweet This Quote

My advice is document everything you do and do it early.

Dan Heelan

Tweet this quote – click here

In my experience as both an entrepreneur and coach, where most small businesses drop the ball when growing beyond their founder, is losing sight of why he or she founded the company in the first place.

All businesses evolve as they level up, usually going through one or two pivots. Or more. These shifts may be modest or a complete sea change.

Some may be driven by the founder, others by market conditions or something else. But they are inevitable so get used to them.

The founder, in turn, may find themselves at odds with the new direction yet steadfastly seek to maintain ‘control.’ That is natural, after all, “It’s MY company!” And that’s where trouble starts.

Truth is the founder may have become more of a liability than an asset only they cannot see it (that is where the coach comes in).

Yet, through it all, it was the founder’s vision that got the company there in the first place, a place where you don’t need them anymore!

How’s that for a kick in the head! He or she departs, either voluntarily or by force, and one of two things usually happens – the company thrives, or it dies.

The latter group loses its captain and ends up adrift at sea; the former, never forgets why the founder did what they did, bottles it and keeps on swilling…

Tweet This Quote

Truth is the founder may have become more of a liability than an asset only they cannot see it (that is where the coach comes in).

Henry Daas

Tweet this quote – click here

Wahidah Aziz

— Financial Coach. Helping working women take the stress out of day to day money management.

The most important process/system that small businesses overlook is their customer relationship management (CRM) system.

As business owners we learn pretty quickly that you need to get in front of your customers to make sales. However, once they see the value of your product you have to nurture that relationship and constantly deliver what you promised.

Being a financial coach I have clients at different financial milestones in their lives. I have to be able to meet them where they are financially so they have the best chance of meeting their goals.

Having a CRM allows me to have a clear idea of what a client needs from me and the progress they have made.

I have used Slate and it has made client management a breeze.

A good CRM system should allow you to identify the unique qualities in your clients so you can tailor your email campaigns for them depending on their needs.

It also allows you to keep detailed notes about your clients so every time you speak with them you can start where you left off.

Tweet This Quote

The most important process/system that small businesses overlook is their customer relationship management (CRM) system.

Wahidah Aziz

Tweet this quote – click here

Being in this industry for a long time I believe bookkeeping is something that is being overlooked by most of the small business owners.

Through the years, I met different people who don’t give equal importance to this process well in fact if they really wanted to keep track of their financial records and to properly manage their business this should be considered as an essential part.

For me, not analyzing your expenses day by day is a mistake and could prevent your business from reaching its full potential.

Tweet This Quote

Not analyzing your expenses day by day is a mistake and could prevent your business from reaching its full potential.

Ervin Nixon Cruz

Tweet this quote – click here

I think that the most important system/ process that businesses overlook is having a team that helps balance their core mission with new opportunities.

Most businesses remain too rigid and miss opportunities to grow their business to maturity while other businesses jump from idea to idea without ever having a solid business or product available for the consumer.

I think that having a good grasp of operational capabilities paired with creative growth creates a happy medium and allows a young company the agility and strength to compete with larger and more established players.

So far, our team has focused mostly on managing relevant data from front end client development all the way through to client relationship management.

We mostly use SalesForce and make sure that everyone on our team is proficient in how to use the customizations found on our platform.

Trading excel spreadsheets is the past and our operations team really focuses on keeping the information flowing.

For example, as a start-up, our operational patterns and tracking have changed multiple times in order to match the business model changes.

There are also times when we can capitalize on technology when our business model changes to include existing elements found in software.

A great step forward was when we converted our business model from a customized, untrackable, and permanently manual product to a SaaS model product.

By changing to a SaaS model, we were able to better leverage SalesForce to automatically bill, calculate discounts, as well as keep track of utilization with the contracts.

We may be filled with smart, talented, and hardworking initial team members, but we can not build a business without the ability of our operations to properly scale.

Every initiative we have is built for scale but the operations must be in place to catch the momentum from that initiative.

Tweet This Quote

I think that the most important system/ process that businesses overlook is having a team that helps balance their core mission with new opportunities.

Enpo Tu

Tweet this quote – click here

I think two things prevent growth beyond the founder.

First, they do not develop systems and automation to free up their time.

Second, they do not develop replacement leadership, where everyone is developed as a leader and given ownership incentive to take on that responsibility.

Tweet This Quote

I think two things prevent growth beyond the founder.

First, they do not develop systems and automation to free up their time.

Second, they do not develop replacement leadership.

Marc Page

Tweet this quote – click here

Paul Desruisseaux

— Working in the financial industry since 2017; helping people with liquidity, longevity and estate and legacy strategies.

Visit Paul’s Website

Small businesses are run by the passion of the owner, they are always “on.” Having a long term transition plan in place and finding the next CEO early can be helpful.

As for growing with the original owner, establishing a

standard operating procedure for quality control so the owner feels comfortable delegating can help the business grow.

Tweet This Quote

As for growing with the original owner, establishing a

standard operating procedure for quality control so the owner feels comfortable delegating can help the business grow.

Paul Desruisseaux

Tweet this quote – click here

I would say the most important process that a small business overlooks when it comes to growing beyond the founder is the idea that the founder has to do it all. Business growth, just like wealth creation, is a team sport, not a solo sport.

The founder needs to determine where they want to fit in, or not fit in at all.

If we use the example of an orchestra, does the founder want to be in the first violin position, be the conductor, or own the orchestra hall and have nothing to do with running the orchestra.

Once that is established he can determine who he or she needs to bring on board.

Support from a qualified Certified Public Accountant who has similar business clients would be a great team member to add. Also a banker with similar clients. There are business coaches that could make good team members.

When I started over at age 50 I worked with my wife and a Realtor on my team, plus a contractor, painter, landscaper, roofer, plumber and insurance agent. We all worked together and made money.

Tweet This Quote

Business growth, just like wealth creation, is a team sport, not a solo sport.

Rennie Gabriel

Tweet this quote – click here

The key is to surround yourself with experts, with people who are better at what they do than you are then start working on your own redundancy.

By working on my own redundancy I mean enable the business to function without me; to make myself the least important person in the business.

In my experience, SMEs are typically ‘ego’ businesses –without the owner they don’t operate, therefore without the owner they have no value.

When I need an expert I make sure to define the brief in detail then go find a freelancer who has a demonstrable track record of having delivered the desired outcome multiple times previously.

Tweet This Quote

The key is to surround yourself with experts, with people who are better at what they do than you are then start working on your own redundancy.

Martin Beadle

Tweet this quote – click here

Build a process that’s repeatable and scalable by anyone.

Map out customer touchpoints and give them a rating out of ten and ask can I a) improve this and b) automate this.

Many things can be improved or scaled by technology but usually the small businesses owner mindset that traps them into thinking their business can only survive if they do everything.

That’s the difference between successful founders/business owners and others.

Tweet This Quote

Map out customer touchpoints and give them a rating out of ten and ask can I a) improve this and b) automate this.

Ben Nowlan

Tweet this quote – click here

I think most small business owners overlook having solid processes documented to allow new team members to be able to get up to speed as quickly as possible.

On this note, owners can easily underestimate the time needed to bring a new team member to a productive level.

The first step to creating the process documentation is to record the current state. For computer work, using a video capture software like Zoom can make this very easy.

Non Computer-based processes may require a little more work. However, purchasing a tripod and recording the physical steps can help start the process.

Having a network of other business owners to discuss growth with is my favorite way to avoid underestimating the time needed to bring a new team member up to speed.

This group should ask good questions and challenge you on your expectations. Personally, I have found a mastermind group has worked best.

Tweet This Quote

Having a network of other business owners to discuss growth with is my favorite way to avoid underestimating the time needed to bring a new team member up to speed.

Joshua S. Duncan

Tweet this quote – click here

The biggest mistake I saw working with small business owners is that many do not have a written process for everything they do.

A small business owner intuitively knows how to run their business, but oftentimes forget that it’s not intuitive for others.

Every part of the business should have a written process that anyone can follow.

This means the business owner has to think through their vision and mission and clearly have who they are, what they do, who they serve, and how they serve written.

Tweet This Quote

A small business owner intuitively knows how to run their business, but oftentimes forget that it’s not intuitive for others.

Every part of the business should have a written process that anyone can follow.

Tania Brown

Tweet this quote – click here

It depends on the skills of the founder

– if the founder is an engineer, financial reporting systems are often lacking.

– if the founder is a person with financial experience, the missing systems are usually around controlling product development.

Most small businesses do not have any management structure, and if the founder is young, external business experience on a board or management group is often needed.

The last thing is many founders would do well to join something like The CEO Institute or find a mentor.

Tweet This Quote

Most small businesses do not have any management structure, and if the founder is young, external business experience on a board or management group is often needed.

Ron Lesh

Tweet this quote – click here

Louis Marchman

— Providing Income Tax Preparation along with Accounting and Bookkeeping for Businesses and Individuals.

Visit Louis’s | LinkedIn

They don’t come up with enough scripts, established procedures and written policies, so that owners can move into focusing on building their brands instead of working for them.

Example: I use an online Small Business CRM called HoneyBook.com to keep track of all my procedural guidelines, documents and templates.

Then just being consistent about adhering to the policies you set for your business.

Tweet This Quote

Established procedures and written policies, so that owners can move into focusing on building their brands instead of working for them.

Louis Marchman

Tweet this quote – click here

My answer to your question is definitely accurate bookkeeping, although I might be a little biased.

Bookkeeping is extremely important to businesses of all sizes. It allows the owner to see how the business is doing which then shows how much money they can spend on expanding. It will also show what areas aren’t really profitable and they can cut down expenses accordingly.

If you don’t know where you stand money wise in your business, then how do you know if you even have the means to expand?

Profitability isn’t just shown by how much you have left in your bank account.

That doesn’t take in what you spend for expenses each month or keep track of how much money you need to collect from customers to have.

It doesn’t show the whole picture basically.

So my answer is definitely bookkeeping and also a good workflow system combined.

I honestly and truly believe that these are the two most powerful (behind the scenes) softwares/systems a person can use for their business.

Tweet This Quote

If you don’t know where you stand money wise in your business, then how do you know if you even have the means to expand?

Kaiyah Bean

Tweet this quote – click here

In my experience working with business owners in different industries, founders overlook some important processes or systems depending on the size of the business.

For example, it’s not uncommon to see a founder who is the only employee in his company miss monthly reconciliation of the accounts or forget to integrate a new bank account or credit card accounts into the accounting software.

Not having this routine in place will not only get the accounting books messy, but the owner might continually lose money unknowingly. It will be difficult to trace back returns to any investment or expenses.

Founders who have employees sometimes overlook having a smooth filing process of expenses and documentation. It’s okay to put checks in place but to avoid long closing period which can run into another accounting period,

it’s advisable to have an automated filing and documentation process with time periods from the date that the transaction was made.

Doing this keeps the accounting books updated before the next accounting period and reduces errors.

Tweet This Quote

Not having this routine in place will not only get the accounting books messy, but the owner might continually lose money unknowingly.

Elizabeth Leonard

Tweet this quote – click here

I think that is a difficult question and perhaps not a process or system but more of a personality trait or traits.

I think the ability to delegate is the biggest obstacle. Also the understanding and acceptance that the work will not be done 100% the way you would have done it but often times ends up in the same results.

Tweet This Quote

I think the ability to delegate is the biggest obstacle.

Cindy Schroeder

Tweet this quote – click here

As a bookkeeper and business manager of small businesses my observation has been, often as companies grow beyond their founder, they need to reevaluate all their systems, to be sure all employees have access to all the data and tools, they would need to get that data from the field to accounting.

Tweet This Quote

Often as companies grow beyond their founder, they need to reevaluate all their systems, to be sure all employees have access to all the data and tools, they would need.

Cheryl Graham

Tweet this quote – click here

The most important foundation (IMO) any entrepreneur should have is a financial foundation.

You would be surprised how many people start a business without doing the most basic steps:

1. Get a Federal Tax ID for the business so their personal Tax ID is not floating around.

2. Set up a business bank account to keep business transactions and personal transactions separate. This is important for personal liability protection. It also helps an audit go smoothly.

3. Consider your entity choice. Although sole proprietorship may be all you need, consider forming an LLC. Although there may be a cost involved, the additional business liability protection it offers can be well worth the money.

Remaining a sole proprietor allows your personal assets to be at risk if you should be sued.

4. Speak with an insurance person to see if you should have some general liability insurance.

I would also encourage every founder to speak with an accountant or bookkeeper in setting up their accounting system. In lieu of that, they should read an introduction to bookkeeping book or article. Every business owner should be familiar with what Assets, Liabilities and Capital are and what a Balance Sheet and Profit and Loss are.

Tweet This Quote

Every business owner should be familiar with what Assets, Liabilities and Capital are and what a Balance Sheet and Profit and Loss are.

Sherry Thomason

Tweet this quote – click here

“The Whole Is Greater Than Sum of Its Parts” – You Can’t (or Shouldn’t) Do It Alone.

“I am so tired.”

“You need to get an assistant or hire someone.”

“I don’t know. I tried that before and it didn’t work out.”

“How come?”

“I don’t know. I felt like I always was explaining things and it wasn’t done right and I just ended up doing it myself.”

Sound familiar? Some of us have been there and we always hear, “You need to delegate or hire out or outsource.” But sometimes it’s not that easy.

There’s a level of trust and learning to let go and for some, it’s like dropping off your child to the new daycare for the first time.

Unfortunately, when we keep pulling away from letting go we find ourselves right back where we started – in the beginning, and continuing the cycle all over again and wondering why our company or business isn’t growing as fast and why are we even more tired?

The challenge for many small business owners though is that we say we want to grow but are we willing to allow that to happen?

There are some things we need to understand for our businesses to grow beyond just us.

1. Do a great job of finding the right people.

It’s critical to find the right people and give them a fair chance. What do I mean by that? Make your objectives clear.

There have been times in the past when people have asked me they wanted my help and they didn’t even know what they wanted. They knew they needed help, but weren’t even sure.

You as the leader need to have that clear vision. Be clear in what you’re trying to accomplish and give the person a chance to share their ideas while you offer your own. This is part of the trusting process.

We have to allow that person to feel valued. Be open-minded that they will be seeing challenges from a fresh perspective and may have solutions that you may not have thought of.

2. Build your team.

Eventually, we need to come to terms that we cannot do this alone if we truly want to scale and grow.

There comes a time when you realize that you are getting bogged down by tasks and duties that could easily be done by someone else that can put more attention, time, and focus towards those parts of the project or process.

Perhaps you start with an assistant, then add a marketing coordinator and sometimes this can start as part-time or on a contractual basis.

You’ll need to strategize what parts of your operations need the most attention that will make the biggest and most affordable difference right now.

3. Know your team’s strengths and weaknesses and what lights them up.

I would suggest that you keep this in mind when finding the right people so you begin with the end in mind. When you’re clear on what you want to be accomplished, it will make it easier to know what to look for.

Everyone has different strengths and when they can operate in that space, it allows them to flow and shine from a higher level of performance. Think about those tasks you can’t stand.

For example, I enjoy speaking and shooting video and being in a creative space while others are perfectly content handing detailed-oriented tasks at their desk all day.

Everyone has their thing. The problem is when we don’t ask or find out what is the thing that lights our people up. Are we allowing them to shine?

Did we even ask? When we get the right people on the team, we all begin to move towards progress and we allow them to operate in their core genius.

4. Take care of your people.

Your team is there to help you, the company, each other, and themselves. We have to look out for our team and always keep their well-being in mind. Are we supporting them? Are we helping them to grow?

Most importantly, are we listening to what they need or their concerns? Do we hear them out when they have frustrations or ideas? Do you ask who needs help or is stuck? I’ve seen amazing teams grow because their leader supports them 110%.

There is this rallying around them and one another. It’s all about creating a culture where everyone wants to help and serve and step up. When we don’t create this, you know what happens.

We get half-ass work, people are just there to do the bare minimum, and there is no excitement to grow. They can’t stand their boss. It’s more like, “When can I go home and get the heck out of here?”

What kind of culture do you want to create? Remember that everyone has a voice and wants to be seen, heard, and feel supported.

5. Be on the same page.

Too often I see businesses where the people that are involved sometimes don’t know what’s happening and often it’s because the founder isn’t communicating with their team regularly.

When there is a lack of communication, so much gets lost. No one is being heard and the culture doesn’t grow into a positive one.

When we’re reminded of the vision and what the overall goal is and what we need to do to reach it, we stand behind one another to accomplish it. I recently partnered with a financial company and every morning we have a team huddle for 15 minutes.

We each go around sharing our wins, what we need help with, and the one thing we’re striving to accomplish that day. Then we end with an inspiring quote to encourage us to win the day!

When the founder invests time and shares the vision, the team comes together because we want the same thing and want to help one another get there.

I know the common thing said here was growing the team, but at the end of the day, the biggest most important process/system that small businesses overlook to grow and scale beyond the founder is to realize that you have got to create a system that is sustainable without you.

If your vision is big enough and you want it to grow beyond you, you cannot let your ego or pride or lack of asking for help get in the way. Your goal and vision have to be bigger than you that it requires you to create a team.

There is no other way to go about it. Sure, you can attempt to do it alone, but it will be a lonely and harder journey and that is no fun. No wildly successful business owner has ever said they did it alone.

There are always accolades to the team of people that they built. There is joy and fulfillment in knowing what kind of people you helped develop.

And most of all, in whatever way your business helps others, knowing that you made an impact on the community and people that you serve is so much sweeter when you know you had others supporting the big dream that started only with you in the beginning.

Tweet This Quote

No wildly successful business owner has ever said they did it alone.

Jen Fontanilla

Tweet this quote – click here

Additional Reading

- Filipino Financial Advisor Gives Us Her Tips And Tricks |INTERVIEW|

Loren Fogelman

— Founder of Business Success Solution. Expert in pricing strategy and sales. She delivers talks across the United States at major conferences such as Inbound as well as many niche conferences. From 2018 to 2020 she’s been steadily recognized by HubSpot in its list of the world’s top 22 business coaches.

You wear all the hats when you first start out in your business. Because it’s yours, you want things a specific way.

Control issues often get in the way of your business growing. You tell yourself no one else can do the work to your standards.

When you hold onto all the tasks, you become the bottleneck. This slows down business growth in two ways.

You hold onto tasks which you don’t enjoy and lie outside of your expertise.

Instead of delegating lower level tasks, you continue to do work below your pay grade.

It’s possible to lighten your workload without sacrificing your standards.

Don’t continue to hold onto tasks below your pay grade. Time-consuming busy work sucks up your time, limiting your growth. Over time your initial enthusiasm turns into a grind. You start to burn out.

Delegation is a lesson in letting go. It’s possible to build a team of people who enjoy doing the things you struggle with. They’ll be delighted to take specific tasks off your plate. This singular move frees up your time to focus on your expertise, develop your business and grow your bank account.

Tweet This Quote

Control issues often get in the way of your business growing. It’s possible to lighten your workload without sacrificing your standards.

Loren Fogelman

Tweet this quote – click here

The most important thing businesses overlook is establishing the foundation of their business. By that I mean getting clear on what they are selling to whom and how and putting in place scalable systems to support that.

Almost every business I help has this challenge. Without this clarity and by randomly selecting apps that don’t share data, many businesses lack the data to make timely decisions to change and scal

Tweet This Quote

By randomly selecting apps that don’t share data, many businesses lack the data to make timely decisions to change and scal

Jody Seibert

Tweet this quote – click here

Christina Honeycutt

— Cash Flow Advisor, Bookkeeper, Strategic Debt Elimination | Specializing in Growth & Technology

Visit Christina’s | LinkedIn

When people decide to go into business for themselves, they have a passion and a dream for their future. Most of the time that dream includes being able to have the freedom of working their own schedule and taking off when they want.

However sometimes when you’re starting out, you have the idea that you can do everything yourself to save money. But as time goes by and you’ve reached your limitations as to how many hours a week you can work and how much money you can make in a day, you realize you’ve reached your potential.

The only way to move to the next level of your business is to learn to delegate work to others.

I know this can be hard for some small business owners because that means relinquishing control. You’ve managed every step of your business up till now so passing the baton can be scary. But being a successful business owner also means being a great leader.

By being a great leader not only will your business thrive, but you’ll have a team under you who will help you every step of the way. So don’t limit the potential to reach your dreams with the fear of losing control.

Tweet This Quote

You’ve managed every step of your business up till now so passing the baton can be scary. But being a successful business owner also means being a great leader.

Christina Honeycutt

Tweet this quote – click here

Matthew Tansley

— Founder of ProfitFarmers. Finance, Trading and Cryptocurrency are his languages of choice but what drives him to keep ‘talking’ is his passion for helping others.

Visit Matthew’s LinkedIn

Every business will have different core processes and pain points, depending on whether they have physical products, digital services or other revenue streams.

In all cases though detailed and complete onboarding (and offboarding) processes are paramount.

Why? Well if you can onboard a new recruit ‘off the street’ and confidently know that within a reasonable amount of time they can handle the functions you need…then you are no longer reliant on the founders knowledge or training.

Full onboarding processes are a sign that all of your other Standard Operating Procedures (SOPs) are in place. Go get it done!

Tweet This Quote

If you can onboard a new recruit ‘off the street’ and confidently know that within a reasonable amount of time they can handle the functions you need…then you are no longer reliant on the founders knowledge or training.

Matthew Tansley

Tweet this quote – click here

Businesses differ in many ways. There is no single “most important system/process that all small businesses must master to grow beyond the founder.”

Some need better financing, some need to improve operations, some need to systematize their marketing, and there are other issues as well.

Founders are idiosyncratic. If there is one answer it is this: figure out the weakness of the founder and fix it.

Tweet This Quote

There is no single “most important system/process that all small businesses must master to grow beyond the founder.”

David Merkel

Tweet this quote – click here